White & Case has advised Bank Polska Kasa Opieki on the issuance of PLN 750 million (approximately EUR 175.5 million) subordinated capital bonds.

New NPL Act in Hungary

Hungary has taken major strides towards modernising its framework for non-performing loans (NPLs) with the introduction of Act XII of 2025 on servicers of non-performing credit agreements and purchasers of non-performing credit agreements. The new legislation, which will come into force on 16 May 2025, implements the EU's Directive 2021/2167 into Hungarian law, thereby establishing a comprehensive system for the transfer, management and servicing of NPLs. These reforms are poised to transform the Hungarian NPL market, creating new opportunities and responsibilities for both domestic and international investors.

BTA Solivan Advises Celtic Park Piaseczno and Celtic Park Lomianki on Warehouse Refinancing

BTA Solivan has advised Celtic Park Piaseczno and Celtic Park Lomianki on the financing and refinancing of warehouses and office complexes located near Warsaw by mBank. Eversheds Sutherland reportedly advised mBank.

Dentons and Gide Advise on PLN 760 Million Financing for Noho One

Dentons has advised BNP Paribas Bank Polska, mBank, and Santander Bank Polska on a PLN 760 million (approximately EUR 181.8 million) senior loan facility to Noho Warszawa for the construction of Noho One. Gide advised Noho.

Kinstellar, Greenberg Traurig, Clifford Chance and Lakatos, Koves and Partners Advise on CCC's PLN 3.66 Billion Sustainability-Linked Financing

Kinstellar and Greenberg Traurig have advised CCC on its recent PLN 3.66 billion (approximately EUR 850 million) financing increase provided by a consortium including mBank, the EBRD, Bank Pekao, BNP Paribas Bank Polska, PKO Bank Polski, Santander Bank Polska, and Bank Handlowy w Warszawie, alongside Santander Factoring, mFaktoring, PKO Faktoring, and BNP Paribas Faktoring. Clifford Chance and Lakatos, Koves and Partners advised the banks.

Baker McKenzie and Esin Attorney Partnership Advise Sunset Hospitality Group on Investment from Goldman Sachs

Baker McKenzie and its Turkish affiliate Esin Attorney Partnership have advised Sunset Hospitality Group on a financing round led by Goldman Sachs.

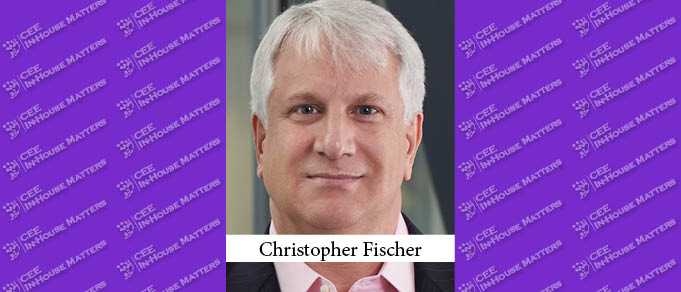

Christopher Fischer Joins DenizBank as Group Head of Legal

Former Accenture Senior Legal Contract Manager Christopher Fischer has become the new Group Head of Legal at DenizBank.