In The Debrief, our Practice Leaders across CEE share updates on recent and upcoming legislation, consider the impact of recent court decisions, showcase landmark projects, and keep our readers apprised of the latest developments impacting their respective practice areas.

2025 Turkish GC Summit Sneak Peek: Interview with Kerem Turunc of Turunc

Turunc Managing Partner Kerem Turunc discusses the upcoming 2025 CEE Legal Matters Turkiye General Counsel Summit due to take place in Istanbul on November 4, 2025.

No Tolerance for On-Site Inspection Obstruction – TCA Slaps Record EUR 33 Million Fine on BIM

The integrity of on-site inspections remains a cornerstone of effective competition law enforcement. The Turkish Competition Authority (TCA)’s decision to impose a record-breaking fine on BIM Birlesik Magazalar A.S. (BIM), one of Turkiye’s largest retail chains, has drawn considerable attention from international businesses and the legal community.

Bulgaria’s Renewables Market Catches Second Wind

Bulgaria’s renewable energy sector has seen significant growth in recent years. In 2024, almost 1 gigawatt of new renewable energy capacity was connected to the grid, predominantly from solar energy. Notably, no new wind farms have been commissioned since 2012, primarily due to administrative barriers and local opposition. However, investor interest remains high, especially in the southern and northwestern regions. Projects like the 238-megawatt Tenevo hybrid solar plant in Yambol, which plans to integrate a solar park, wind turbines, and energy storage, exemplify this trend.

Practicalities of Data Incidents Involving EU Data Subjects and Non-EU Companies

The contemporary European market witnesses a large number of highly operational business models that target European consumers and are, simultaneously, managed outside the European Union. There are businesses whose central administration or decision-making hubs are not established in any EU member state. Some of them neither control nor process data of their consumers within the EU. At the same time, some of these businesses are also subject to strict and enforceable international regulations in addition to the applicable EU legislation.

Bulgaria: An Attractive Destination for Technology-Driven Businesses and Investors

Bulgaria’s Technology, Media, and Telecommunications (TMT) sector is continuing its steady and dynamic growth, reflecting the country’s ongoing digital transformation and its increasing role as a regional technology hub.

Bulgarian M&A Market in 2025 – A Modest H1 with an Eye on Euro Integration

The first half of 2025 in Bulgaria’s corporate and M&A landscape has been characterized by a modest start amidst global economic and political uncertainties. Many export-oriented industries faced a challenging 2024, impacting the financial projections of potential targets. However, the outlook remains largely positive, fueled by major upcoming developments.

A Promising Future for Bulgaria’s Energy Mix

Bulgaria’s energy sector has been undergoing deep and rapid reforms. The combination of the effects of the war in Ukraine and the related sanctions, the European Green Deal and the rapid decrease of investment costs for renewables, the commitments for a coal-free future, and the neighboring discoveries of natural gas in the Black Sea – all combined with the unprecedented support for nuclear energy – is putting Bulgaria on the global investment map.

Guest Editorial: “So Your Hourly Rate Is 500 EUR…”

This is not the sentence commonly heard in law firms across the region at the moment. But that might not be the case for much longer.

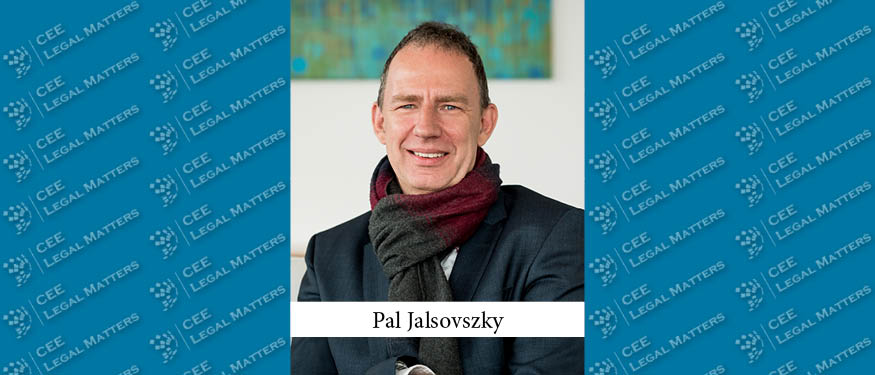

The Corner Office: Inflationary Pressure

In The Corner Office, we ask Managing Partners at law firms across Central and Eastern Europe about their backgrounds, strategies, and responsibilities. This time around, we dug deeper into a discussion point that came up during our last event: During our annual General Counsel Summit held in Prague recently, we’ve learned that even with the inflation in CEE having hovered around 14-20% in recent years, legal fees have remained static or have even decreased in some jurisdictions. Given that, how has your firm managed to consistently deliver high-quality service under these constraints?

“Don’t Trust That Email” – An Increasingly Recurring Note from Law Firms

An increasing number of law firms have been publicly warning about the misuse of their names in phishing and cyberattacks. PRK Partners Partner Michal Matejka, Musat & Asociatii Partner Stefan Diaconescu, Gugushev & Partners Partner and Head of Data Protection Yoanna Ivanova, and DLA Piper Hungary Partner and Head of Intellectual Property and Technology Zoltan Kozma discuss the growing trend.

Looking In: Interview with Jan Andrusko of Perkins Coie

In our Looking In series, we talk to Partners from outside CEE who are keeping an eye on the region (and often pop up in our deal ticker) to learn how they perceive CEE markets and their evolution. For this issue, we sat down with Perkins Coie London-based Partner Jan Andrusko.

Cybersecurity in the AI Age

As AI increasingly intersects with nearly every dimension of digital security, so too does the consciousness of creating conditions to use it in a secure cyberspace. As Space Hellas Group General Counsel Konstantinos Argyropoulos puts it, “there is an acceleration in the way AI interfaces with cybersecurity,” pointing to an emerging arms race in which malicious actors and defenders alike adopt increasingly automated tactics. Argyropoulos shared his thoughts on this during the CEE Legal Matters GC Summit 2025 in Prague.

In RE RO: Romania’s Real Estate Surge

Over the past few years, Romania’s property market has matured from a fragmented landscape into one defined by stability, sustainability, and strategic sectoral shifts. Musat & Asociatii Partner Monia Dobrescu, Tuca Zbarcea & Asociatii Partner Razvan Gheorghiu-Testa, and Nestor Nestor Diculescu Kingston Petersen Partner Vlad Tanase take a closer look at how secondary cities are outpacing the capital in price growth and major players are doubling down on assets.

A Regional Standout: Romania’s Vibrant Legal Media

Romania’s legal media has been remarkably vibrant, outpacing its regional peers in both volume and influence. Juridice.ro Executive Director Daria Niculcea, who has witnessed its evolution firsthand, Act Legal Marketing Manager Ana Maria Manea (Pandelea), with the experience of the firm’s regional marketing strategy across 18 markets, and Pro/Lawyer CEO Mate Bende who provides PR consultancy examine how different factors shaped this unique ecosystem.

FDI Momentum in North Macedonia

Foreign direct investment in North Macedonia has surged in recent years, with 2024 marking a particularly strong period for inflows, despite global uncertainties such as supply-chain disruptions and regional economic slowdowns, according to Law Office Lazarov Managing Partner Dragan Lazarov and Cakmakova Advocates Junior Partner Vladimir Bocevski.

Fresh Leadership, Fresh Focus: Macedonian Competition Authority Picks Up Speed

Driven largely by fresh blood in its leadership, North Macedonia’s Commission for the Protection of Competition (CPC) has been noticeably more active in the past month, according to ODI Law Partner Gjorgji Georgievski. The stage has been set for rigorous enforcement and heightened consumer protection, redefining how market players navigate compliance in the country.

Inside Insight: Interview with Mihaela Scarlatescu of Farmexim

Farmexim Head of Legal and Compliance Director Mihaela Scarlatescu discusses her 25-year legal journey, leading in-house strategy across pharma and retail, and balancing legal precision with business impact.